Blog

How to Choose Glass Wine Bottles | Complete Guide for Wineries

A Complete Procurement Guide for Wineries, Distilleries, and Beverage Brands

Choosing the right glass wine bottles is far more than a packaging decision. For wineries and spirits brands, bottle selection directly affects product stability, regulatory compliance, logistics efficiency, and brand perception. Whether you are sourcing bottles for high-volume everyday wines or developing customized packaging for premium and ultra-premium labels, a scientific selection process helps reduce procurement risks and long-term costs.

This guide provides a structured, industry-based approach to selecting glass wine bottles, combining technical standards, market practices, and real-world procurement considerations.

Why Glass Wine Bottles Remain the Global Standard

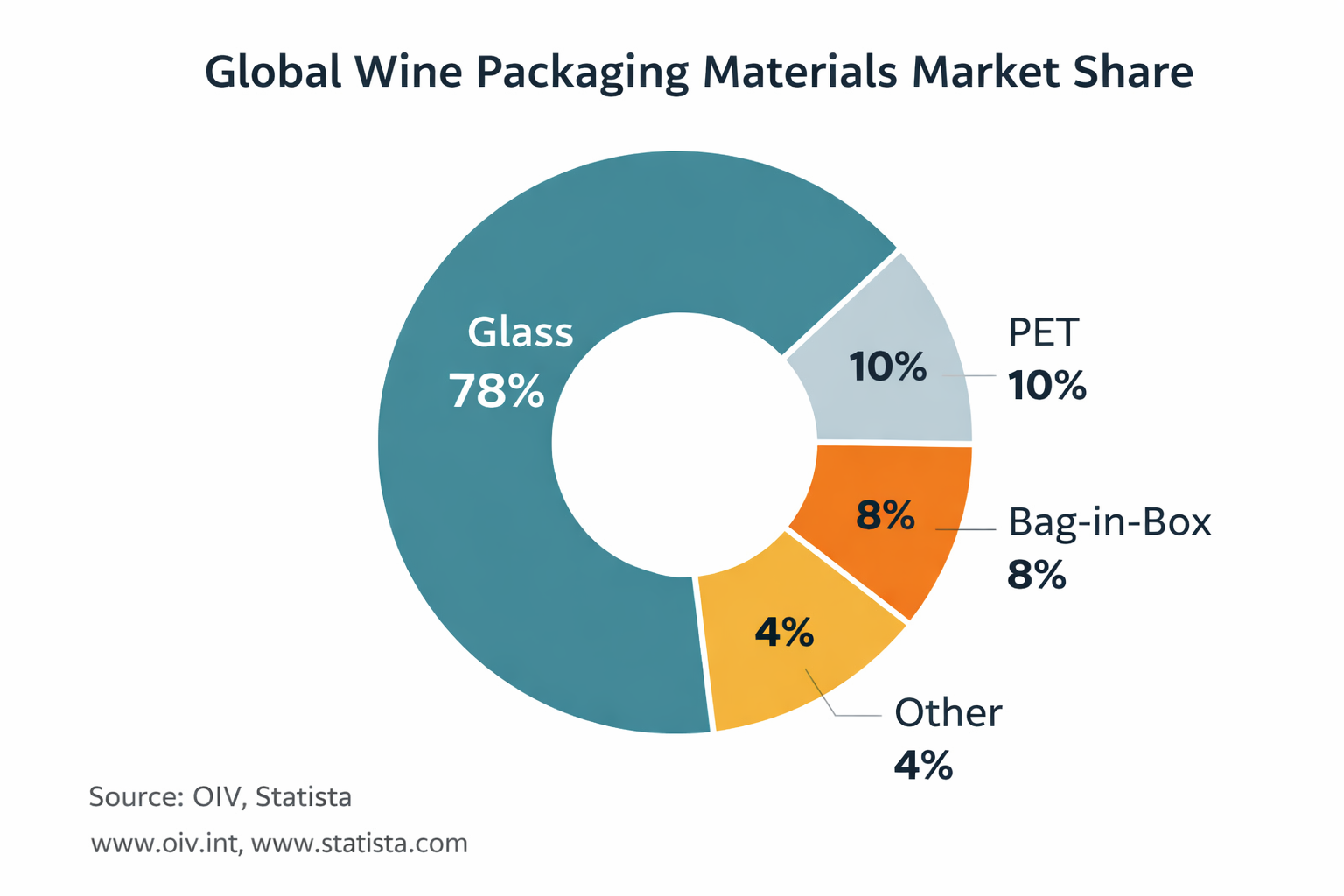

Glass has been the dominant packaging material for wine for decades—and this position remains unchanged. The reason is simple: glass is chemically inert, non-porous, and highly stable. It does not react with wine, does not absorb aromas, and provides an effective barrier against oxygen and external contaminants.

According to the International Organisation of Vine and Wine (OIV), the vast majority of wines traded internationally—especially those intended for aging or premium positioning—are packaged in glass bottles.

Industry reference: https://www.oiv.int

In addition, glass is fully recyclable and increasingly aligned with sustainability goals. Modern manufacturing innovations now focus on lightweight glass, enhanced mechanical strength, and custom bottle designs, enabling wineries to reduce carbon footprint and transportation costs without compromising quality.

Global Wine Packaging Materials Market Share (%)

Glass | PET | Bag-in-Box | Other

Source: OIV / Statista

https://www.statista.com

1. Understanding Glass Bottle Materials and Grades

Not all glass wine bottles are created equal. Differences in raw materials and production processes result in varying optical quality, strength, and cost.

Common Glass Grades Used in Wine Bottles

| Glass Grade | Characteristics | Typical Applications |

|---|---|---|

| High-flint glass | High clarity, low impurities | White wine, sparkling wine, spirits |

| Crystal glass | High refractive index, luxury appearance | Premium whisky, brandy |

| Standard flint glass | Cost-efficient, reliable | Table wines, daily consumption |

High-clarity glass enhances visual appeal and is often associated with premium positioning, while standard flint glass offers a balance between performance and cost for volume-driven products.

2. Bottle Color and Light Protection

Light exposure—particularly ultraviolet (UV) radiation—can negatively affect wine quality by accelerating oxidation and altering flavor compounds. This makes bottle color a critical functional consideration, not merely an aesthetic choice.

Light Protection by Bottle Color

| Bottle Color | UV Protection Level | Recommended Use |

|---|---|---|

| Dark green / amber | High | Red wine, long-term aging wines |

| Milky white (opaque) | Medium | Signature or iconic packaging |

| Clear (flint) | Low | Spirits, white wine, visual display products |

Industry research consistently confirms that darker glass bottles provide superior protection for wines intended for extended storage.

Industry reference: https://www.winebusiness.com

Comparison of clear, green, and amber glass wine bottles under light exposure.

3. Bottle Shape, Weight, and Structural Design

Beyond color and material, the physical design of a glass wine bottle affects handling, storage, and logistics.

Key design factors to evaluate:

-

Bottle weight: Heavier bottles convey a premium feel but increase shipping costs.

-

Wall thickness uniformity: Affects strength and impact resistance.

-

Base (punt) design: Influences stability and perceived quality.

For export-focused wineries, lightweight bottles with reinforced structure can significantly reduce transportation expenses while meeting durability requirements.

4. Closure Systems and Sealing Performance

Sealing performance plays a decisive role in preserving wine quality throughout its shelf life. Even the best glass bottle cannot compensate for a poorly designed closure system.

Critical sealing components:

-

Bottle neck finish precision

-

Closure type (cork, synthetic stopper, screw cap)

-

Liner or gasket material

Food-grade silicone liners and natural cork liners are widely used due to their elasticity, chemical resistance, and aging stability. Before large-scale procurement, wineries should conduct inversion tests, leakage tests, and simulated aging tests to validate sealing performance.

Cross-section illustration of bottle cap liner and bottle neck interface.

5. Regulatory Compliance and Food Safety Standards

Glass wine bottles must comply with strict food-contact regulations, especially for international markets. Compliance is not optional—it is a baseline requirement for market access.

Common regulatory standards:

-

FDA (United States)

-

LFGB (European Union)

-

GB 4806.5 (China)

-

Third-party verification such as SGS

Key compliance indicators include:

-

Heavy metal migration limits (lead, cadmium)

-

Impact resistance testing

-

Thermal shock resistance

-

Wall thickness tolerance (commonly ±0.1 mm)

References:

https://www.fda.gov

https://www.sgs.com

6. Evaluating Glass Wine Bottle Manufacturers

Selecting a reliable glass wine bottle supplier is just as important as choosing the bottle specifications themselves.

Manufacturer evaluation checklist:

-

Automated production lines for consistency

-

Precision mold development capabilities

-

In-house quality testing equipment

-

Customization services (shape, embossing, closures)

-

Stable lead times and after-sales support

Whenever possible, factory audits provide valuable insights into production discipline, quality management systems, and supply reliability.

Factory production line, quality inspection process, or palletized warehouse storage.

7. Practical Procurement Best Practices

To reduce sourcing risks and optimize costs, wineries should adopt the following best practices:

-

Request samples before mass production

Conduct physical testing and compliance verification. -

Align bottle grade with product positioning

Use standard glass for volume wines and premium glass for flagship products. -

Plan customization timelines early

Custom molds and closures require longer development cycles. -

Balance cost and sustainability goals

Lightweight glass can significantly reduce carbon footprint and shipping costs.

Conclusion

Glass wine bottle procurement is a strategic process that integrates technical performance, regulatory compliance, cost efficiency, and supplier reliability. By applying a structured evaluation framework, wineries and beverage brands can secure packaging solutions that protect wine quality, enhance brand value, and support long-term growth in global markets.